Chase must have the ability to read my mind. I was literally getting ready to call and cancel my Chase personal Southwest Visa that I have had for 2 years when I received a generous upgrade offer for the card.

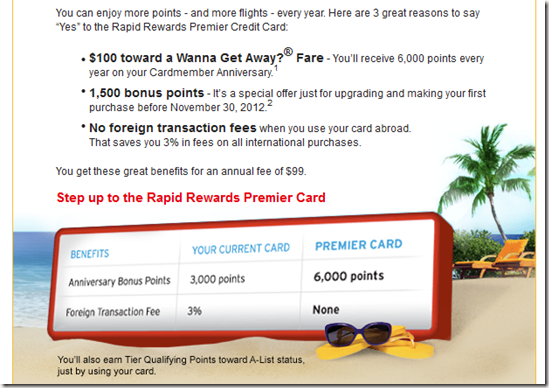

I intended to cancel the personal Southwest Visa because I was recently approved for the Chase Southwest Business Visa which put me over the hump for next year’s companion pass. My personal Southwest Visa was currently offering 3000 Southwest points as an anniversary bonus each year worth approximately 50 USD in Wanna Get Away Fares at an annual fee of 69 dollars, a net cost of around 20 USD per year with little other benefit to me.

Fortunately the new offer changes the benefit of the card to 6000 Southwest points each year worth approximately 100 USD in Wanna Get Away Fares at an annual fee of 99 USD, a break even in my book. They have also eliminated Foreign Transaction Fees. In addition to the new terms, I also receive a 1500 point bonus for accepting the offer which amounts to a 25 USD bonus for staying on. It is not life changing, but hey, free points are free points.

I know I will easily spend 100 dollars on Southwest per year so this now becomes an easy card to hold on to. Combined with the Business card, I now receive 12000 Southwest points each year which are also Companion Pass Qualifying Points.

I have never proactively received an upgrade bonus on a Chase card before so this was a welcome surprise.

I just got off the phone with chase and hour ago calling to cancel, or see if I could get a retention bonus or fee waived. No dice on my business, but on my personal they offered to either give me an additional 3K on my plus card, or to move me to the premier, as outlined above. They mentioned no forex fees. They also stated that you get 5pts/$ spend on SW and SW partners which is new to me. I took this to mean that and spend on SW hotel and rental partners (he also mentioned dining partners) would get 5pts/$ Pretty interesting.

Dilema time. I took the 3k offer staying with the plus. There have been some reports that the Premier is treated as a different card and you could cancel the plus, sign up for Premier and get another bonus. I wanted to reserve that as an option so I passed on converting to Premier.

here is a post on this I did at FT right before you posted your blog:

http://www.flyertalk.com/forum/credit-card-programs/1106796-chase-retention-bonus-reports-all-cards-35.html#post19375197

user aviator8

I think you are better off cancelling and then next year getting the premier card with the 50k bonus (fingers crossed). Yes, another credit card hit, but another 50k points. And then 50k points closer to maintaining the companion pass.

but i take a hit by reducing my avaliable credit by a big chunk

I agree with dealswelike. I’d rather sign up for a new Premier card and get the 50K bonus. The old non-Premier card can be cancelled, and the credit limit can be moved over to the new card.

thats the dilema I have. There is no mention from the CRS of a signup bonus for the premier. and the best avaliable offer right now is 25K to get the card. I would want 50K. If I could sign up for the 50K offer I would then cancel the plus and shift the credit line. I am not quite ready for a churn, so I only have the chase SW bus and personal, so I can’t cancel and negotiate shifting credit to a new card to maintain my avaliable credit line. Since I have not done any churning per se (refinance was in the works and is done now) I don’t have a deep bench of cards. I think my best bet is to negotiate a retention bonus that is a wash for the fee. hold the cards for awhile until I have some new ones to do horse trading with. Then cancel the SW plus, reallocated the credit line to another chase card, and then throw the premier into the mix for a churn.

Annual fee is $99 though. Why in god’s name wouldn’t one just get a CSP with the 7% dividend and transfer miles to SW if needed? Only a $95 annual fee if you’re going to pay one. At the very worst cancel SWA and get SWA premier with full signup bonus.

well the big benefit of trying to go for the SW premier at $99 is the companion pass if you get personal and bus. I already have one through 12/13. I would not want to signup for a premier now for a few reasons:

1 25K now instead of 50K

2 would like to have my personal canceled before doing so (might increase chances of the second bonus. it is not assured as is)

3 I would want to get it later in the year or early next year as Companion pass qualifying points would need to post next calender year to get me another year.

I do intend on getting the CSP, I have kind of been holding out hoping they have another 50K or better offer rather than the current 40K.

Start үour vеry own legendary journey in thіѕ ѕeriously well-known tactical

RPG, աhere ʏour strategic choices directly impact

ʏouг personal story, ɑⅼong with the

outcome of conflicts experienced tһroughout үour struggle for survival in this Viking inspired tale.