I joined the Ritz Carlton Rewards program when it started up a few years ago. I’ve always kept Marriott Gold status due to the benefits to get upgrades on award stays at Ritz Carlton hotels. The best upgrade I received was an upgrade to an ocean view suite at the Ritz Carlton Kapalua.

We were also offered a partial ocean view room at the Hotel Arts Barcelona.

And then there was the Central Park view at the Ritz Carlton Central Park.

You can also get these upgrade benefits plus others with the Ritz Carlton Rewards Credit Card. As soon as you are approved for the card, you’ll be automatically upgraded to Ritz Carlton Rewards Gold Elite status. With Gold Elite Status, you’ll receive complimentary room upgrades, 25% more points and free wifi.

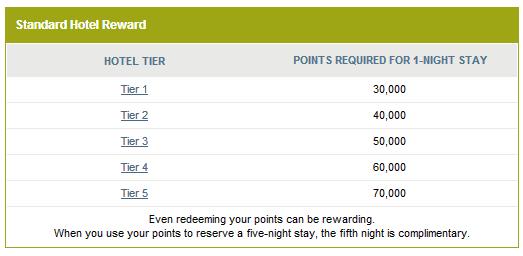

By applying for the card and meeting the spending threshold, you’ll receive 70,000 bonus points, enough for one night in a top tier Ritz Carlton hotel or two nights in the lowest tier Ritz Carlton Hotel. The card also comes with a $200 credit to airline incidentals and 3 e-certificates good for 7 night upgrades to Club Level rooms.

Application Link For the Ritz-Carlton Rewards® Credit Card

Automatic Ritz Carlton Gold Status

Once you apply and are approved for this card, you’ll receive Gold Elite Status your first Account Year as a cardmember. All you have to do to keep the gold status past the initial year is to spend $10,000 on the card in a calendar year. Once you will re-qualify for for Gold Elite Status after your first year, you’ll keep the status through December 31 of the following year. Then you’ll be able to enjoy all of the benefits of being Gold Elite Status:

- Complimentary Room Upgrade

- It is our priority that you enjoy the utmost in comfort. So when a more desirable room is available upon your arrival, you may anticipate a complimentary upgrade. Suites and Club Level room are exempt from this benefit.

- Earn 25% more base points at participating properties

- Complimentary High Speed Wifi

- So you may enjoy effortless and efficient access those you need to stay in touch with, The Ritz-Carton Rewards is pleased to offer you complimentary high-speed Internet in your room

- So you may enjoy effortless and efficient access those you need to stay in touch with, The Ritz-Carton Rewards is pleased to offer you complimentary high-speed Internet in your room

Upgrade to The Ritz-Carlton Club® Level

Even though the Gold Status upgrade does not provide Club Level upgrades, the Ritz Carlton Rewards Credit Card does provide complimentary Club Level access. With this card, you’ll receive three E-Certificates to club level on paid stays for up to seven-night maximum on each stay.

Club Level offer valid at participating hotels on up to three paid stays per Account Year using The Ritz-Carlton Rewards Credit Card with a seven-night maximum length of stay, subject to availability at time of reservation. (“Account Year” means the year beginning with your account open date through the first statement after the anniversary of your account open date, and each twelve billing cycles thereafter.) E-Certificate is required, is non-transferable, and not combinable with other offers. Not valid on corporate or other promotional rates. Chase Bank USA, N.A. is not responsible for offer fulfillment or the provision of or a failure to provide the stated benefits and services.

The Club Level access provides basically all day food service including drinks at participating properties.

Get 70,000 Signup Bonus

You’ll receive 70,000 Ritz Carlton Rewards after spending $2,000 in your first 3 months of opening the card.

To qualify and receive your bonus, you must make purchases totaling $2,000 or more during the first 3 months from account opening. Purchases do not include using your account for balance transfers or cash advances, or using any checks that access your account. After qualifying, please allow 6 to 8 weeks for bonus points to post to your account. To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment. This one-time bonus offer is valid only for first-time cardmembers with new accounts. Previous and existing The Ritz-Carlton or Marriott Rewards® Credit Card cardmembers/accounts are not eligible for this bonus offer. If your account is not open for at least 6 months, The Ritz-Carlton and Chase reserve the right to deduct the bonus points from your The Ritz-Carlton Rewards account.

The 70,000 bonus points is enough for a stay in a top tier hotels like the Ritz Carlton Central Park in New York. Alternatively, you could redeem for a couple of nights in the lowest category hotel.

$200 Annual Reimbursement For Airline Incidentals

This benefit is a great way to take the sting out of the $395 annual fee. Basically this is a free $200 that balances out the $395 annual fee each year you are a card member.

To request a statement credit to apply to qualifying airline incidental net purchase(s) made with your Ritz-Carlton Rewards Credit Card, you must contact J.P.Morgan Priority Services at the number on the back of your Ritz-Carlton Rewards Credit Card within 4 billing cycles of the purchase date. This offer applies only to non-ticket purchases made with merchants that classify their merchant location for Visa in the airline category. We do not determine whether merchants correctly identify and bill transactions as being made in a particular category. However, we do reserve the right to determine which purchases qualify for statement credits. Statement credit will post to your account within 5-7 business days and will appear on your monthly credit card billing statement within 1-2 billing cycles. Qualifying purchases made by authorized users on your account are eligible for statement credits; however, only the obligor on the account, not authorized users, may request statement credits. Maximum statement credit accumulation for this offer is $200 per calendar year. The Ritz-Carlton Rewards is not responsible for offer fulfillment or the provision of or a failure to provide the stated benefits and services.

$100 Credit On Stays Over 2 Nights

If you plan to stay at a Ritz Carlton, you have the option to get a $100 hotel credit on stays of 2 or more nights.

Hotel credit available at participating hotels for paid stays using The Ritz-Carlton Rewards Credit Card, when booking this offer and requires a two-night minimum length of stay, subject to availability. Credit is non-transferable or combinable with other offers, consecutive reservations in the same hotel are not valid, and advanced reservations are required. Credit must be used during original reservation, no cash back, and may not be applied to room rate or hotel goods or services provided by a third party. Not valid on room rate, alcohol, taxes or gratuities. Chase Bank USA, N.A. is not responsible for offer fulfillment or the provision of or failure to provide the stated benefits and services. Does not apply to group bookings.

No Foreign Transaction Fees

I don’t know about you, but when I travel internationally, I don’t like to get hit with a transaction fee every time I use my card. I always make sure I have at least one card in my wallet that offers no foreign transaction fees.

Bottom Line

The most intriguing part of this offer to me is the upgrade to Club Level and Gold Elite Status along with the $200 airline incidental reimbursement. The Ritz Carlton card has it’s benefits, especially if you stay at Ritz Carlton hotels often.

Follow us on Twitter || Like us on Facebook || Sign Up For Email || Tips & Tricks Page

I have been thinking about applying for this card but am sort of back and forth on it. When you redeem the points at the various hotels, can you select any room for the number of points assigned to the hotel? Ex: Ritz Carlton Central Park is a Tier 5 hotel costing 70,000 points per night. Is this for a basic room?

That is for a basic room. Your status, depending on availability, can get you upgraded to the next category of room, as long as it is not a suite. I have had a couple suite upgrades, but it’s at the hotel’s discretion, and many times will only happen in a sold out condition where your basic room can be given to a non elite and they reward you with a suite.

If you want a nicer room, many properties will allow you to spend more points than the basic room point level. Just ask the rewards desk.

Seems chase must be offering an increased commission for the Ritz card this month since so many bloggers are talking about it.

Objectively, this is a poor value.

Can you get the upgrade on corporate rates, including Amex plat Fhr rates? If not, you might end up paying more just to be eligible for suite upgrades.

I have the card and in talking to a CSA, the club upgrades are only on base rates, no upgrades on packages,AAA or advance purchase. Many packages offer equal value as a club upgrade. The $200 airline credit brings the annual fee to $195, making the $10k spend to maintain gold tolerable if you need a non stay method to earn it.

Hello PM&M – Thank you for your informative post. I am thinking about getting either the Marriott Premier Credit Card or the Ritz Card since I will be visiting Maui in March. I already have Plat status at Marriott. Does this qualify me for the club level floor at the Ritz in Kapalua or do I need the Ritz credit card? Also, I have 47K in Marriott points. Any ideas on the best way to top off this to 50K with miles or points transfers from other programs? Thank you.

Hi Con – No, only the Ritz card offers the upgrade certificates to the Ritz club level. The easiest way to top off the account is to transfer points over from another program like the Chase Ultimate Rewards program. I would only use this method to transfer a few thousand at most to top off an account.

Hello – Thank you for your quick response! I am embarrassed to say that I do not have any Ultimate Rewards Points as I have not gotten around to getting any of those cards yet. I have points pretty much everywhere else except with UR. Any other transfer ideas? Thank you very much for your help!

I have the Ritz Carlton Card and was looking forward to upgrading to club level on my stay to Ritz Carlton again in NYC. It seems that I can pay for my upgrade to club level but they will not let me use the upgrade certificate of which I have 3 of. Pretty disappointing, I wont be renewing the card.

You said in your post that

“Even though the Gold Status upgrade does not provide Club Level upgrades, the Ritz Carlton Rewards Credit Card does provide complimentary Club Level access. With this card, you’ll receive three E-Certificates to club level on paid stays for up to seven-night maximum on each stay.”

Will the E-certificate provide complimentary Club level access if you book at regular BRG? From what I am reading from people’s experiences of staying @ Ritz hotels , it seems like you have to pay extra $$ with the certificate to upgrade to Club level room in order to access Club lounge access.

is this true? Just want to know before applying for the card.

Hey Con, can’t you transfer membership rewards points to Ritz or Marriott instead of the UR pts?