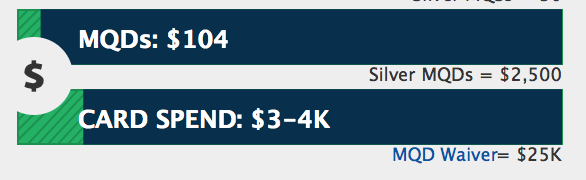

Delta recently put into affect their new Medallion Qualifying Dollars requirement, where SkyMiles members must not only fly the required amount of miles to maintain their Medallion status, but now must meet certain revenue spending requirements.

Consider these Offers

Looking for More Delta Miles?

See current Credit Card Offers here to earn more miles.

Why To Get a Delta SkyMiles Credit Card

However, instead of having to spend the required revenue requirement, US members can receive a waiver if they spend $25,000 per year on their Delta SkyMiles credit card.

MQD Waiver: The new MQDs requirement for the qualification year will be waived if you make at least $25,000 in Eligible Purchases in that year with your Delta SkyMiles Credit Card from American Express. That spending is tracked everywhere you see your MQDs.

Since the spending takes place for the calendar year, it’s best to get a card now and start spending since you’ll have a full 12 months to be able to spend $25,000.

The current bonuses for the Delta cards are:

Looking for More Delta Miles?

See current Credit Card Offers here to earn more miles.

Delta SkyMiles Credit Card Eligible Purchases are the total of purchases for goods and services less returns and other credits. Fees, interest charges, balance transfers, cash advances, purchases of traveler’s checks, the purchase or reloading of prepaid cards and purchases of other cash equivalents will not count toward Eligible Purchases.

Your total spend across all Delta SkyMiles Credit Cards that are linked to the same SkyMiles number will be combined and count toward your annual total of Eligible Purchases, meaning that if you have multiple cards, all the spending will count toward the $25,000 requirement.

Personally, I’m already on my way to spending the 25,000 on my Delta SkyMiles American Express cards. How about you?

I have both the Personal and Business Platinum Delta Skymiles Card. I predict that at some point this year, (Most likely towards the end of the year). Delta & Amex will offer a MQD waiver for New Sign-Ups of a Delta Plat or Reserve Card. Would make sense, because unlike last year this year if you’re a 5k or 10k MQM’s short, but also MQD’s short for the next level, signing up for the card wouldn’t help you.

Either that or you would be able to “Buy MQD’s” which would be also something Delta could do I suppose.

Or better yet, give up on delta altogether since their miles are not valuable and they have shown a history of not caring about loyalty