As the year is almost over, I was looking at my credit card spending for this year, and noticed that on my Delta co-branded card, I was several thousand short to spending $50,000, which means I would be losing out on the 10K Medallion Qualifying bonus.

However, I decided to try to manufacture spend using my Square account as they charge a 2.75% fee, which would have been easier than buying PayPal cards or what not.

I have a square reader and have used it on occasion to have friends pay me for stuff (however, now everyone uses Venmo). I created a sale for several thousand dollars and swiped my credit card, signed the receipt and thought all was well.

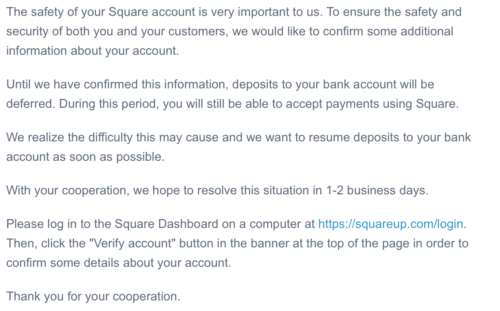

However, the next day I got the following email from square saying they wanted to verity my identity:

I filled out the verification form, and then the next day received the following message from Square:

We reviewed your account and found some payments that violate the Square Terms of Service. As a result, we won’t be able to deposit funds for these payments into your account. We apologize for any inconvenience this may cause.

Under our Terms of Service, you cannot process prepaid cards, gift cards, or your own credit card using your Square account. The Square Terms of Service also prohibit using Square as a money transfer system. You must provide a legitimate good or service in exchange for every payment processed with Square.

Please refund the payments in question. If you aren’t sure how to refund a payment, this Support Center article will help you. It usually takes two to seven days for refunded payments to get credited back to the original payment card.

Please understand that if you process these types of payments again, we’ll have to deactivate your Square account.

Bottom Line

I was really disappointed that I would have to refund my payment and that this wouldn’t be a good way to manufacture spend. I guess looking back, it would be better to have a Square account in a family member’s name or a friend and then pay them, as you wouldn’t be violating the rule of “your own credit card using your Square account”.

Lesson learned, now I sit here several thousands short towards where I need my spend to be.

Anyone used Square before? Feel free to share your successes or failures below.

I can’t believe you tried this. Probably violates terms of all the accounts and related services.

C’mon man. You obviosly cant swipe your own credit card with your own Square account. What are you, a newbie?!?!

They really should have deleted your account for violation their TOS. Count yourself lucky

Since I no longer use square, I can tell you that I have done that in the past, and I imagine it was the amount that flagged it. My guess is over $1K would set off alarms. However, I have had friends do this when I used Square and when I use my current bank merchant services. I just “sell” them something ( careful..don’t let your mind wander here weirdos! ) and have had no issues.

I can swipe my wife’s Card ( I Checked with them on this). I just cannot swipe A CARD IN MY NAME. Nothing wrong with, -AHEM-, swiping my wife’s Card with her name on It (that just happens to be An Authorized User Card from 1 of my accounts), LOL.

Of course, with 2.75% Fee, I usually reserve this for Sign-Up Bonuses.