It’s that time of year again. The tax man is coming and you need to prepare and file your taxes. At the same time it makes sense to get your record keeping in order for next year. Just in time is this Southwest Rapid Rewards bonus offer for up to 1,500 bonus points. Here are the details:

How To Earn 1,500 Bonus Southwest Points

- Earn 1,000 bonus Rapid Rewards Points when you file with TurboTax

- Earn 500 bonus Rapid Rewards Points when you purchase a Quicken product

Promotion Details

I received a message this week informing me that I can earn up to 1,500 bonus points with Southwest if I file my taxes through TurboTax and purchase a Quicken 2014 product. Great, I was going to file my taxes anyway, at least I”ll earn points now.

Dear Weekly Flyer,

For a limited time only, Southwest Airlines Rapid Rewards® has teamed up with TurboTax® and Quicken® to bring you two special offers. You can earn 1,000 points for filing your 2013 federal taxes with TurboTax® Online and 500 points for purchasing Quicken 2014 personal finance software.

Terms And Conditions

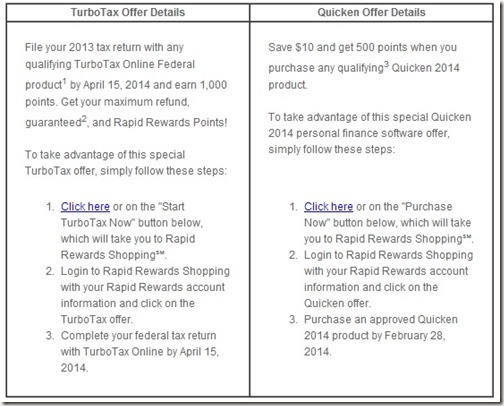

TurboTax Offer Terms and Conditions: To be eligible for this offer, you must (1) click the offer from this e-mail which will direct you to the Rapid Rewards Shopping site, (2) login with your Rapid Rewards account information and click on the TurboTax offer, and (3) complete your federal taxes with TurboTax Online between January 3, 2014 and April 15, 2014. Limit one redemption per Rapid Rewards account number. Please allow six to eight weeks from the date of filing your taxes with an approved TurboTax Online 2013 Federal product for your Rapid Rewards account to be credited with 1,000 points. Points will not count toward A-List or A-List Preferred qualification. All Rapid Rewards rules and regulations apply.

Quicken Offer Terms and Conditions: To be eligible for this offer, you must (1) click the offer from this e-mail which will direct you to the Rapid Rewards Shopping site, (2) login with your Rapid Rewards account information and click on the Quicken personal finance offer, and (3) purchase an approved Quicken product between January 3, 2014 and February 28, 2014. Limit one redemption per Rapid Rewards account number. Please allow six to eight weeks from the date of purchasing an approved Quicken 2014 product for your Rapid Rewards account to be credited with 500 points. Points will not count toward A-List or A-List Preferred qualification. All Rapid Rewards rules and regulations apply.

12013 TurboTax Online Federal Products Qualifying for 1,000 Rapid Rewards Points are the online version of TurboTax Federal Free Edition, TurboTax Basic, TurboTax Deluxe, TurboTax Premier, and TurboTax Home and Business. Excludes any other product or offer. CDs or downloaded products do not qualify for the offer.

2Maximum Refund Guaranteed: If you get a larger refund or smaller tax due from another tax preparation method, we’ll refund the applicable TurboTax federal and/or state purchase price paid. Claims must be submitted within 60 days of your TurboTax filing date and no later than June 15, 2014. Optional add-on services excluded. Cannot be combined with TurboTax Satisfaction (Easy) Guarantee. See TurboTax.com for full details.

32014 Quicken qualifying products include Quicken Starter Edition, Quicken Deluxe, Quicken Premier, Quicken Home & Business, and Quicken Rental Property Manager. Excludes any other product or offer. Approved TurboTax and Quicken Affiliate. TurboTax, TurboTax Online, and Quicken, among others, are registered trademarks and/or service marks of Intuit, Inc. in the United States and other countries. Other parties’ trademarks or service marks are the property of the respective owners.

Bottom Line

I was going to file my taxes anyway this year, now I’ll earn bonus miles doing so.

In terms of tracking, I usually just keep track of my business spending through my American Express Open business card and my Chase Ink Plus and Ink Bold Business cards, but the Quicken tool actually seems like it will integrate well into bank accounts, credit card accounts and might be helpful in preparing my taxes for next year.

Do you plan to take advantage of any bonus offers to file your taxes electronically this year?

Related Posts

- Free Companion Travel With Southwest–Easy Way To Earn Companion Pass With 50,000 Offer

- Free 750 Southwest Points And 100 My Coke Rewards Points

- Southwest is getting TSA Pre-check!

- Does Southwest want to start charging for bags?

- Southwest nationwide double points promotion live

Sign up for Email || Twitter || Facebook || Tips & Tricks

Hotel Offers || Airline Offers || Bank Offers || Cash Back Offers

Leave a Reply