It’s the beginning of 2015, which means now is the best time to get look at your credit card strategy and maximize earning points and miles as well as status with credit cards. In this credit card review series, we’ll take a look at some of the credit cards in the travel space and share with you the benefits of the cards along with reasons to pick up the card or not.

In this post, we’ll look at the U.S. Bank FlexPerks® Travel Rewards Visa Signature® card.

U.S. Bank FlexPerks® Travel Rewards Visa Signature® card -Â

Get 20,000 bonus FlexPoints after the first $3,500 in net purchases within the first four months.

- Get 20,000 bonus FlexPoints after the first $3,500 in net purchases within the first four months.

- Award travel starts at just 20,000 FlexPoints (up to a $400 ticket value) on over 150 airlines with no blackout dates or online redemption fees Earn one FlexPoint for every $1 of eligible net purchases charged to your card

- Earn two FlexPoints for every $1 spent on gas, grocery or airline purchases — whichever you spend most on each monthly billing cycle — and on most cell phone expenses

- Earn Triple FlexPoints for your charitable donations

- $0 intro Annual Fee* the first year, after that $49*

- Earn 3,500 bonus FlexPoints each year when you spend $24,000 in Net Purchases.

- You can redeem these FlexPoints for your annual fee or combine them with other FlexPoints for travel or many other rewards

20,000 Bonus FlexPoints + 3,500 each year

You will get 20,000 Bonus FlexPoints after you spend $3,500 in purchases in the first 4 months. 3,500 Bonus FlexPoints each year when you spend $24,000 net purchases.

- Only 20,000 FlexPoints = up to a $400 ticket.

2x FlexPoints/$1

On gas, grocery, or airline – whichever you spend the most on each monthly billing cycle and on most cell phone expenses.

3x FlexPoints/$1

On charitable donations

No Annual Fee First Year

$49/ year after that.

Key Link: APPLY for the U.S. Bank FlexPerks® Travel Rewards Visa Signature® card.

Airline Award Redemption

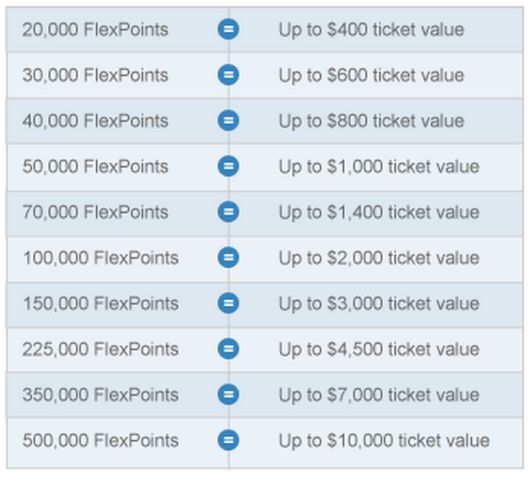

With the airline flight award redemption, you can redeem points at certain pre-defined rates. The redemption rates are based on the table below. The best part is these award flights are revenue tickets so you’ll earn miles in your program of choice when you redeem your FlexPerks.

- FlexPerks award travel redemption is an easy search and booking process based on date, destination and airline. With more than 150 airlines, you’ll find many more flight and carrier options than you would on a single airline web site.

- You can even earn frequent flyer miles/points for your FlexPerks award travel when you fly participating airlines.

- Just enter your airline frequent flyer number when requested as you book your flight or add it at check-in.

- Award travel redemption is easy – just enter departure and destination cities and travel dates in the search window.

- When your search is complete, available flights are displayed along with the number of FlexPoints needed to redeem a round-trip ticket.

- You can sort the results by airline, schedule, number of stops, points required and more. Standard airline taxes and fees are included in your redemption, so there are no surprises.

- The dollar value of your award travel ticket is shown before you commit to redeem your FlexPoints, so you can ensure you’re getting the best value for your FlexPoints.

- To redeem your award travel by phone, call 888-229-8864 between 8:00 am and 11:00 pm (CST) Monday through Friday and 8:00 am to 9:00 pm (CST) Saturday and Sunday.

Bottom Line

20,000 FlexPoints is worth up to a $400 ticket! The U.S. Bank FlexPerks® Travel Rewards Visa Signature® card has no annual fee the 1st year and then a pretty nominal fee after the 1st year. Overall, this card will get you on your way to some free airline tickets starting with the first 20,000 points! This card is also very flexible because you will earn the bonus 2x FlexPoints on the category were you spend the most money.

Leave a Reply