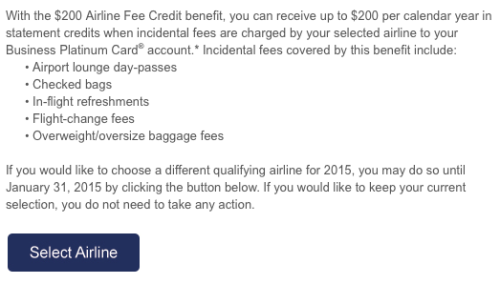

Here’s a reminder if you have The Business Platinum® Card from American Express like I do, you have until the 31st of January if you want to change your Airline partner for your $200 airline fee credit. If you didn’t like having the airline that you had last year, you can change it by logging on to your account. If you are happy with your selection, you don’t have to do anything to keep it the same.

Airline Selection Time For Your $200 Airline Fee Credit On AMEX

If you don’t already have The Business Platinum® Card from American Express now is a great time to get one.

Fine Print on $200 Airline fee credit:

1. Benefit is available to Consumer and Business Platinum Card® and Centurion® Members only. To receive statement credits of up to $200 per calendar year toward incidental air travel fees, Card Member must select a qualifying airline. Only the Basic Card Member or Authorized Account Manager(s) on the Card Account can select the qualifying airline. Card Members who have not chosen a qualifying airline will be able to do so at any time. Card Members who have already selected a qualifying airline will be able to change their choice one time each year in January or by calling the number on the back of the Card. Card Members who do not change their airline selection will remain with their current airline. Statement Credits: Incidental air travel fees must be charged to the Card Member on the eligible Card Account for the benefit to apply. Purchases made by both the Basic and Additional Card Members on the eligible Card Account are eligible for statement credits. However, each Card Account is eligible for up to a total of $200 per calendar year in statement credits across all Cards on the Account. Incidental air travel fees must be separate charges from airline ticket charges. Fees not charged by the Card Member’s airline of choice (e.g. wireless internet and fees incurred with airline alliance partners) do not qualify for statement credits. Incidental air travel fees charged prior to selection of a qualifying airline are not eligible for statement credits. Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. The airline must submit the charge under the appropriate merchant code, industry code, or required service or product identifier for the charge to be recognized as an incidental air travel fee. Please allow 2-4 weeks after the qualifying incidental air travel fee is charged to your Card Account for statement credit(s) to be posted to the Account. We rely on airlines to submit the correct information on airline transactions, so please call the number on the back of the Card if statement credits have not posted after 4 weeks from the date of purchase. Card Members remain responsible for timely payment of all charges. To be eligible for this benefit, Card Account(s) must be active and not in default at the time of statement credit fulfillment. If a charge for any incidental air travel fee is included in a Pay Over Time feature balance on your Card Account (for example, Sign & Travel), the statement credit associated with that charge will not be applied to that Pay Over Time feature balance. Instead, the statement credit will be applied to your Pay In Full balance. For additional information about this benefit, call the number on the back of your Card.

Bottom Line

I think The Business Platinum® Card from American Express cards provide a lot of great benefits consider those here.

If I’m currently set on US, but don’t take advantage until post merger and US disappears, you think I’ll get credit for AA purchases?

I think I would just change it to AA if you are planning to take advantage of $200 fee credit after the merger.

I’m current set on US Air and have some trips on US Air so I rather not change. Would it automatically be changed to AA after programs merge?

Good question Jim. Maybe, but i can’t vonfirm. To be safe I would just call in and change when you are done with your US Airways bookings.