It’s the beginning of 2015, which means now is the best time to get look at your credit card strategy and maximize earning points and miles as well as status with credit cards. In this credit card review series, we’ll take a look at some of the credit cards in the travel space and share with you the benefits of the cards along with reasons to pick up the card or not.

In this post, we’ll look at the U.S. Bank FlexPerks® Business Travel Rewards Visa® Card.

U.S. Bank FlexPerks® Business Travel Rewards Visa® Card Benefits

You will get 20,000 bonus FlexPoints after the first $3,500 in net purchases in the first 4 months!

- Get 20,000 bonus FlexPoints after the first $3,500 in net purchases in the first 4 months

- Award travel starts at just 20,000 FlexPoints (up to a $400 ticket value) on over 150 airlines with no blackout dates or online redemption fees

- Earn one FlexPoint for every $1 spent in net purchases

- Earn double FlexPoints on the category you spend the most on (gas, office supplies or airline) and most cell phone expenses during each billing cycle

- Earn Triple FlexPoints on qualifying charitable donations

- Receive an airline allowance of up to $25 with every award travel ticket to use toward baggage fees, in-flight food or drinks and more

- $0 intro Annual Fee* the first year, and $55 per year thereafter (+$10 for employees)

20,000 Bonus FlexPoints

You will get 20,000 Bonus FlexPoints after you spend $3,500 in purchases in the first 4 months.

- Only 20,000 FlexPoints = up to a $400 ticket.

2x FlexPoints/$1

On gas, office supplies, or airline – whichever you spend the most on each billing cycle and on most cell phone expenses.

3x FlexPoints/$1

On charitable donations.

$25 with every award travel ticket

Receive an airline allowance of up to $25 to use toward baggage fees, in-flight food or drinks and more.

No Annual Fee First Year

$55/ year after that (+$10 for employees.)

Key Link: APPLY for the U.S. Bank FlexPerks® Business Travel Rewards Visa® Card here.

Airline Award Redemption

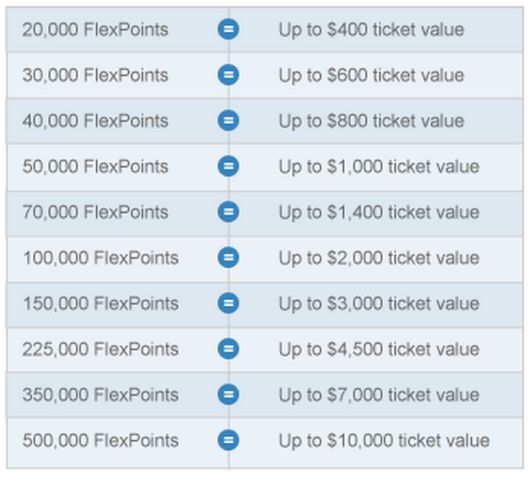

With the airline flight award redemption, you can redeem points at certain pre-defined rates. The redemption rates are based on the table below. The best part is these award flights are revenue tickets so you’ll earn miles in your program of choice when you redeem your FlexPerks.

- FlexPerks award travel redemption is an easy search and booking process based on date, destination and airline. With more than 150 airlines, you’ll find many more flight and carrier options than you would on a single airline web site.

- You can even earn frequent flyer miles/points for your FlexPerks award travel when you fly participating airlines.

- Just enter your airline frequent flyer number when requested as you book your flight or add it at check-in.

- Award travel redemption is easy – just enter departure and destination cities and travel dates in the search window.

- When your search is complete, available flights are displayed along with the number of FlexPoints needed to redeem a round-trip ticket.

- You can sort the results by airline, schedule, number of stops, points required and more. Standard airline taxes and fees are included in your redemption, so there are no surprises.

- The dollar value of your award travel ticket is shown before you commit to redeem your FlexPoints, so you can ensure you’re getting the best value for your FlexPoints.

- To redeem your award travel by phone, call 888-229-8864 between 8:00 am and 11:00 pm (CST) Monday through Friday and 8:00 am to 9:00 pm (CST) Saturday and Sunday.

Bottom Line

The U.S. Bank FlexPerks® Business Travel Rewards Visa® Card is a great business card option. The 20,000 bonus points will get you flying for free as only 20,000 FlexPoints = up to a $400 ticket. The annual fee is waived the first year and then only $55/annually after that. You will rack up points quickly as the 2x points will be earned on the category that you spend the most on per billing cycle.

Leave a Reply