The other day I shared with you the details of Discover’s new credit card offering, the Discover It Miles card. With the Discover It Miles credit card you’ll earn miles that can be redeemed for travel or statement credits. The best thing about this new card is that right now, Discover is offering an exclusive promotional offer where cardmember’s will have the miles they earn in the first year doubled.

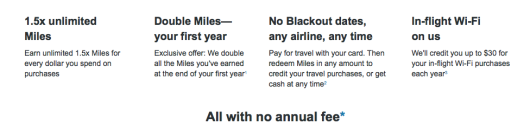

You will get a base of 1.5x miles on all your purchases. After you use your new Discover It Miles credit card for the first 12 months, Discover will double all the miles that you have earned, with no limit!

Why To Get Discover It Miles Credit Card Now

In my mind, this card is great for anyone who can spend a lot on it the first year. I think of the double miles bonus in the first year as the sign-up bonus. So, if you can spend a lot on it the first year, your sign-up bonus is going to be big. For example, if you spend $60,000 in the first year on this card, you will will get double miles bonus worth $900! There is no limit to the amount of miles that you can get doubled!

I’ve been doing a little research and found that Discover tied American Express recently for the highest ranking in credit card customer satisfaction by J.D. Power 2014 U.S. Credit Card Satisfaction Study. This is important because you want to be assured that if something goes wrong, you can trust the credit card company that you partner with.

Discover It Miles Credit Card Overview

1.5x Miles

You’ll get 1.5x unlimited miles for every purchase on the Discover It Miles card.

Double Miles*

At the end of your first year (12 months) with the card, you will get your miles DOUBLED up to no limit! *This promotional offer may not be offered in the future.

Up to $30 Back Wi-Fi

You can get up to $30 back annually when you buy in-flight Wi-Fi, you will get the money back in a statement credit. I will certainly make good use of this benefit.

Free FICO Score

You will get your FICO score for free on monthly statements, mobile app and online.

No foreign transaction fee

There are no foreign transaction fees on this card. I wouldn’t use a card that comes with foreign transaction fees since there are so many that don’t.

No Annual Fee

There is no annual fee with this card. That’s great, especially since you’ll earn 1.5x on every dollar spent.

Key Link to Apply: Discover It Miles credit card

So, now you have applied for and received your Discover It Miles card; what can you do with all the miles that you are going to be racking up?

Redeeming Miles

- Your miles never expire and you can redeem your miles for any amount

- You can redeem to credit your travel purchases on your statement made in the last 180 days

- You can redeem your miles to get the cash back  as an electronic deposit to your bank account

- There are no blackout dates on your travel purchases and you can fly any airline, any time

- Any way you redeem, 1 Mile is the cash equivalent of 1 penny

- Travel Purchases: Travel Purchases include a purchase made within the last 180 days on commercial airline tickets; hotel rooms; car rentals; cruises; tour operators; vacation packages purchased through airlines, travel agents, online travel sites; local and suburban commuter transportation, including ferries; passenger railways; taxicabs and limousines; and charter/tour bus lines. Purchases made using Near Field Communication (NFC), virtual wallets or similar technology may not be eligible.

Bottom Line

Overall, the Discover It Miles Credit Card has a lot of great benefits for a no fee card and is a pretty solid credit card pick. In particular, the doubled miles for the first year! That is on all our purchases, not just some categories like other credit cards. After the first year, you will still earn the 1.5x miles on purchases. The Discover It Miles Credit Card has no foreign transaction fees making it a great card to travel with. You can use your miles to redeem for credit for travel purchases made in the last 180 days on any airline or you can redeem your miles for cash back as an electronic deposit to your bank account. If you haven’t gotten this card yet, it is definitely worth considering if you can put a lot of spend on it the first year!

“Miles” in general have nothing to do with miles, except being redeemed for travel, which this card does. Points can have nothing to do with travel. So these are miles, not points.

Wait, did you really delete my post? For pointing out the difference between points and miles?

Just in case it’s just a glitch, I’ll try again:

I think it’s very deceptive that Discover is calling these “miles”. They have nothing to do with Airline FF miles. They are simply “points” with an exact cash value, and one of these Discover “miles” is much less valuable than a mile in a frequent flyer plan.