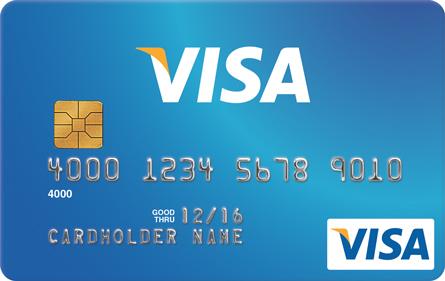

You’ve probably received a new credit card at some point in the past 12 months. That’s because October 1, 2015 was the deadline for businesses to start accepting cards with EMV technology.

These are cards that have a special chip that makes it much tougher for thieves to steal and use credit card data for nefarious purposes.

Credit card companies have been sending customers new cards that feature the chip.

“Our transition to EMV has been very smooth, the team learned the new system easily and our customers have taken to it seamlessly. EMV has meant business as usual for us,†said Brittany Nassar, business manager of Sugarloaf EyeCare, an optometry center and upscale eyewear retailer in Duluth, GA.

In fact, some 68 percent of MasterCard-branded credit cards use EMV technology, according to a new report. The MasterCard report also said that 1.4 million merchants have installed the new technology.

“The whole point of EMV is to reduce counterfeit card fraud,†said Chiro Aikat, senior vice president of product delivery – EMV for MasterCard. “We are impressed with the progress that’s been made so far. We’re taking these steps today to continue the pace of adoption. Making our M/Chip Fast technology available to all parties is our latest investment in this ongoing commitment.â€

Bottom Line

Counterfeit card fraud at stores that accept the EMV technology dipped by 37 percent in January of this year, compared to January of 2015.

This shows that EMV cards are already making commerce safer for consumers, merchants and credit card companies alike.

Instead of swiping your card at the store, cards with EMV technology now must be dipped into the processor.

Leave a Reply