The simple answer, yes! Why does this matter to you? Perhaps you are looking to hit a minimum spend on a new credit card to earn your sign up bonus. Paying your taxes with a credit card could be one potential way for you to hit some bigger spend. Let’s take a look at what it will cost you to pay your taxes with a credit card.

Can You Pay Your Taxes With A Credit Card?

Per the IRS website,

You can pay by internet, phone, or mobile device whether you e-file, paper file or are responding to a bill or notice. It’s safe and secure – the IRS uses standard service providers and business/commercial card networks, and your information is used solely to process your payment.

Fees and Information

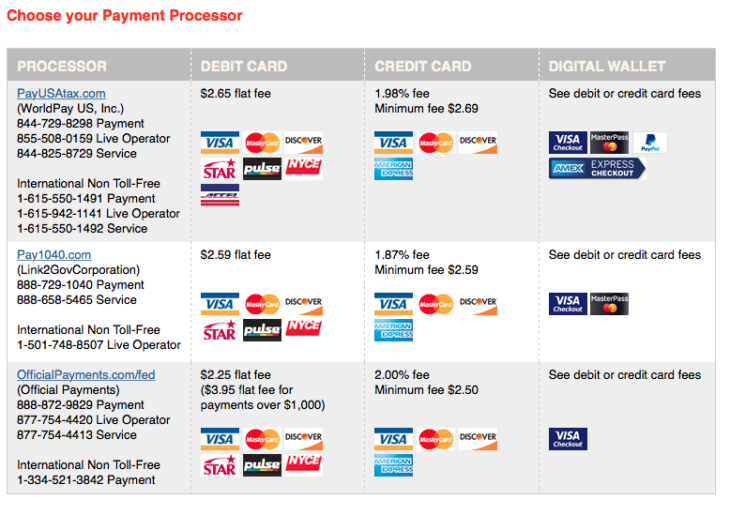

- Your payment will be processed by a payment processor who will charge a processing fee.

- The fees vary by service provider and may be tax deductible.

- No part of the service fee goes to the IRS.

- Your information is used solely to process your payment.

It looks like the lowest fee to do so will cost you 1.87% to pay your taxes via credit card. As an example, if you pay $5,000 in taxes you will pay approximately $93.50 in fees. If you pay $10k in taxes, you will pay $187 in fees. If you owe money to the IRS, it may make sense to use a credit card to pay your taxes, especially if you have a credit card that gives you a big upside to do so like See More Business card offers here.

Bottom Line

If you are still interested in See More Business card offers here, consider the option of paying your taxes with a credit card as one possible way to hit the minimum spend. For all the terms of using a credit card to pay your taxes to theIRS, see their website.

Have you pay1040 in the past with good success. Cheaper than plastiq. Wish I could pay other bills at 1.87%.