As we sat down for some college football and leftover Turkey this week, the conversation took a turn towards points and miles as it usually does. My brother, a small business owner is looking to take his family on a trip next year and asked about ways to increase his point balance. As I dug a little deeper, I was surprised what I found out. Not only does he not care which airline he flies, he has miles and points in over 6 accounts and didn’t know what his balances were or when his points expired. So we sat down at a computer to get his balances sorted out and look at a few ways he could quickly add a ton of miles and points to his point balances.

Step 1: Sign Up For AwardWallet

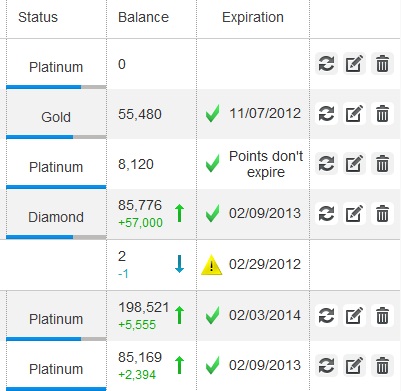

Since he had a ton of points and miles in multiple accounts, the first step we took was to sign-up for an AwardWallet account to track his balances. We setup the account in a few moments and entered in his usernames and passwords. Now he was able to track his balances in one place and receive notifications when his points would expire.

Step 2: Streamline His Flying Program

Since my brother is in a non-hub market, and usually takes flights with multiple carriers, I suggested he signup for the Alaska Mileage Plan account. That way, he can earn status and miles by flying partner airlines like Delta and American Airlines. By crediting all of his miles into one account, he’ll be able to get enough miles for an award quicker, and just might earn status in an airline for once.

Step 3: Get 95,000 Points Added To His Accounts

Since my brother already had a Chase cash back card with a significant balance, I suggest he signup for a Chase card. We looked through a bunch of the card offers and talked about the benefits. He ultimately settled on picking up the personal Chase Sapphire Preferred® Card (where he’ll add another user) and a Ink Plus® Business Card for his small business.As long as he met the minimum spending requirement, he will add an easy 95,000 Chase Ultimate Reward points to his account.

I also suggested he pick up the Platinum Card from American Express so he could take advantage of the airline lounge benefit and the Centurion Lounge, Hilton Gold Status (for free upgrades), $200 in airline credits, complimentary Global Entry membership, and many more benefits.

We could have kept going, but didn’t want to miss out on spending time with the family. So we stuck to the basics. Consolidate where he earns points and miles, add big numbers to his balances, and track them so he doesn’t let them expire. So simple, yet many family members aren’t aware of how easy these steps are and how big of an impact they can have on your point balances and the ability to improve your travel experience.

Bottom Line

Thanksgiving is a great way to catch up with family members. We were thankful we had the opportunity to catch up with our family and my brother was thankful for his new strategy on how to track his point and mile balances.

Did you help any of your family members improve their point balances over the Thanksgiving break?

Key Links:

Sign up for Email || Twitter || Facebook || Tips & Tricks

Hotel Offers || Airline Offers || Bank Offers || Cash Back Offers

Points, Miles & Martinis will earn a referral credit for successful applications through the links in this post. We appreciate any support for Points, Miles & Martinis by using our affiliate links.

Leave a Reply