The first big deal of the year is here and as you would have expected, we didn’t miss out.

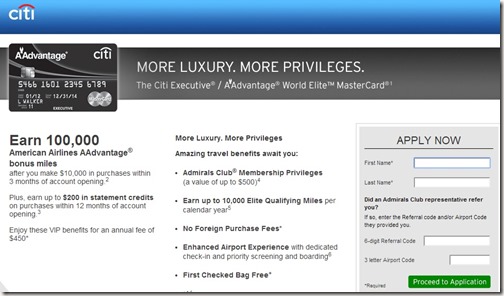

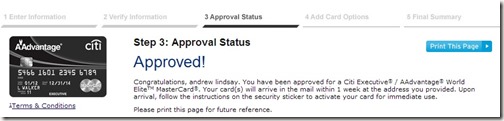

The stories of the 100,000 credit card offer for the Citi Executive® / AAdvantage® World EliteTM MasterCard®started yesterday. I finally completed my application this morning and received an instant approval.

The card offer comes with some great benefits in addition to the 100,000 miles, but it also comes with a $450 fee. Here is a quick run down of the benefits:

- Admirals Club Membership Privileges

- Remember that the American Express Platinum Card just announced they will no longer allow cardmembers access to the AAdmirals Club and the US Airways Clubs starting March 22, 2014. So this card will again provide me access to the AAdmirals Club at a fraction of the retail price.

- A $200 in statement credits on purchases within 12 months of account opening

- This is a great way to effectively take the cost of the card fee from $450 down to $250. In the past, I’ve received a $200 statement credit with American Airlines, so I’ll take the same approach outlined in that article.

- Earn up to 10,000 Elite Qualifying Miles per calendar year

- Nice way to supplement flying to earn status each year with American Airlines.

- No Foreign Purchase Fees

- I may actually use this card internationally because there are no foreign purchase fees.

- Enhanced Airport Experience with dedicated check-in and priority screening and boarding

- Bonus!

- First Checked Bag Free

- Double bonus!

Bottom Line

I decided to apply for the 100,000 offer because 100,000 miles is a lot and I just redeemed 250,000 AAdvantage miles for 5 First Class seats in the same cabin earlier this year.

Plus, the $450 fee can be partially offset by the value of the AAdmirals Club Membership and the $200 statement credit on eligible purchases within 12 months of account opening.

In my mind, I just got 100,000 miles at a real cost of $0.0025 cents per mile and the opportunity cost of cash back on $10,000 in spending, which assuming a 1% cash back card was used would have been $100. Getting 100,000 miles for $300 bucks in my opinion is a good deal.

What about you? Did apply for this offer yet and if not, what are you waiting for?

Related Posts

- American Airlines – Upgrade policy, how even a gold can get one

- My Platinum Amex Experience With $200 American Airlines Credit

- American Express Platinum Update On American/US Airways Lounge Access

- American Airlines – Easy way to find AA record locator when booking through BA.com

- American Airlines – Free award ticket change during Scotland Golf trip

- American Airlines – Earn more miles with dining at your favorite restaurants

- American Airlines – Where to find in flight power outlets

- American Airlines – Earn 1,200 AA miles with Bose headsets

- American Airlines – Using American Airlines miles for unique experiences

- AMAZING US Airways First Class Availability…If You Are Afraid Of Flying Alone

Sign up for Email || Twitter || Facebook || Tips & Tricks

Hotel Offers || Airline Offers || Bank Offers || Cash Back Offers

Not $250, it is $450 with a $200 credit. There is a difference.

I actually think opportunity cost is really 2.2% on a Barclays Arrival or 2c per point on say SPG/UR/MR; but still 100k is a lot of miles.

I’m debating pulling the trigger on an application for this puppy this weekend! I hope it sticks around until the weekend!

Has Citi set a date of when this offer is going to be pulled? I’d like to apply closer to the time of when i cancel my Amex plat. card but also don’t want to miss it. thx

110000 miles

100,000 is a lot of miles, but…

*Not sure how you’ll spend $10k in 3 months. If using Vanilla Reloads that will cost you an additional $79 plus time and effort (assuming all goes smoothly). Small costs like these always seem to be ignored but they add up.

*10k EQM are after $40k(!) in annual spending

*As Nic mentioned the cost isn’t $250. You will pay $450 up front but then get the *next* $200 of spending eventually credited back to you. That’s very different than paying $250 up front.

Instant approval for me. This deal is a complete no-brainer.

Can you still get this card if you already have the basic Citi AA Visa card?