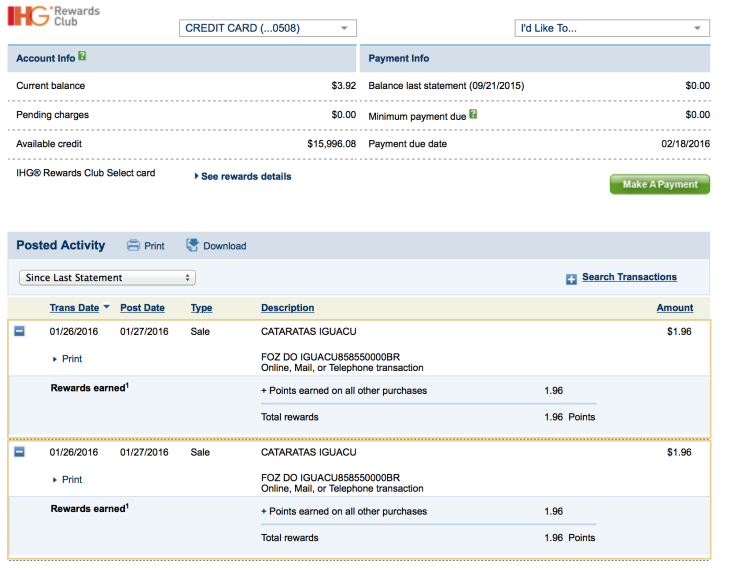

I was a victim of credit card fraud on my IHG Rewards Club credit card account, when I logged in today and noticed two suspicious charges from Brazil from “Cataratas Iguacu” from Brazil each for $1.96. I didn’t make either of these charges, nor have I been to Brazil, meaning that my card was hacked.

I decided to contact Chase who were very helpful and closed this card, and issued me a new one.

I then received the following email from Chase:

We closed your IHG® Rewards Club credit card account ending in 0508 to prevent unauthorized transactions, as we recently discussed.

What happens next

We may send a letter in a blue envelope marked “claims material enclosed” if we need additional information. You’ll confirm the transactions you identified as unauthorized when you sign and return that letter. If you identified transactions that haven’t posted to the account yet, we will research your claim and may contact you with a resolution or for more information.

What you need to do now

• Continue to make at least the minimum payment for the valid balance on the account. You aren’t required to pay for any transactions you identified as unauthorized, including any related interest charges or fees, while we research your claim.

• Please review your next billing statement carefully. If you find additional unauthorized charges on your statement, call us immediately and we’ll research them.

• If you have other users on your account, let them know the account is closed.

• Destroy all credit cards or account access checks for this account. If you recently used an access check or processed a balance transfer, and haven’t already discussed it with us, please call us so we can make sure these transactions are processed when we receive them.

• We’ll send a prepaid envelope with your new card if you have a metal or embedded metal card. Please send the old card back to us and we’ll destroy it.

• You could receive account access checks, re-issued cards, and other materials for your closed account for up to 60 days, but those materials are no longer valid.

Bottom Line

It’s always important to check your credit card statements online to check for any fraudulent charges. Despite the numerous fraud alerts I get on my Chase card, the one time that a fraudulent charge occurred, I received no such alert. Perhaps, it was due to the small amount and the criminals could be trying to test this out to see if it will go through and if so, make a larger charge later.

I quickly phoned up Chase, who assured me that I would not be held liable for any of these charges, and reissued me a new card.

Have you had fraudulent charges on your credit card before? Feel free to share your feedback below.

I’ve had 2 of our 3 Ihg cards have this happen. No others.

Happening all to often any more. I get fraudulent charges at least four times a year on one card or another. I check all of my charges on a weekly basis.

The IHG Chase card has a problem. I use the card maybe 3-4 X per year and I am on now on my 3rd card in less than 14 months. About three weeks ago all I did was update my card on file on my IHG account and the very next day I had a fraudulent charge on the account. The next time it happens I’m getting rid of the card.

One IHG card got 3 charges from Denmark. A few failed attempts too according to Chase cs.

I had Netflix charge in Japan for about $8 on my IHG card and of course notified Chase. Interesting to hear that this happened to others as well. Makes me worry a bit…

Same problem with the IHG card, but no problems with other cards (5 others) with Chase. Rarely used the IHG card and have never used it outside of the US. 6 months ago 8 small charges in Argentina. New card issued which I did not ever use, then last month a $9 charge for Netflix in the Netherlands. Card is more hassle than it is worth.

Also had a problem with my IHG credit card while I was traveling in Europe and hadn’t used it. Hmm, what’s going on with the IHG that is different from other Chase cards?

Applied and approved for the United Mileageplus Explorer VISA. I checked in a few days and looked at my CHASE online account to see if it was already listed. It was. And with a charge of over $125 on it EVEN THOUGH I HAD NOT YET RECEIVED OR ACTIVATED THE CARD. Called CHASE and cancelled it. And I didn’t reissue it since two calls to managers for an explanation were ignored. If a card isn’t secure before I even receive it I don’t want it.

I had two Chase cards last summer with fraudulent charges. One was my Chase Ink and the other was my Freedom. Just this month I had charges on my Discover card.

Also, had fraudulent charges on IHG card. TWICE!

Chase caught the problem both times and reissued new cards.

Why problems twice on a card I rarely use?

Perhaps because it was the only Chase card WITHOUT an EMV chip until recently. Anyone know more?

We have had several problems with Fraud in our Chase credit cards. We had fraud charges on 2 different Ritz Carlton Cards, 1 Hyatt card, 1 IHG card and 1 Sapphire over a year and 6 months period. Seems like Chase has or keeps getting their customer credit card numbers hacked. Chase cancelled each of the accounts in question and we were not responsible for any fraudulent charges, but this ongoing issue is a major inconvenience. All our cards have EMV chips on them.

Two days ago I had 4 charges on my IHG card of $26.95 each. Someone in Europe playing Minecraft.

My IHG card got hit too with a bogus charge from Nextlix in the Netherlands. I used it once in December at a Holiday Inn in Thailand and hadn’t used it for 6 months prior.

I wonder where they’re getting all these IHG credit card numbers from!

Had fraudulent charges on my IHG card and haven’t used the card in over 8 months. They were small under $5 and 1 for one cent. When I called called Chase I was told whomever got a hold of some digits on my card but not the entire number and what the thieves do is start charging at small amounts to see what number combinations have charges accepted then they know they have a created a good card. So where did the partial IHG number come from….the current priceless surprises promotion where we are all mailing in 94 cards with 1st six MasterCard digits!

In the past year, this has happened once with my IHG card, twice with my Chase Sapphire card, once with a Citi card, and once with my SPG Amex card. The Amex incident was with a skimmed card presented at Macy’s in New York one hour after the real card was presented at check in at Sheraton Old San Juan in Puerto Rico. AMEX immediately contacted me. In the other cases, it was my own obsessive checking for pending charges that discovered the problem before the banks did.

Also like Juan above had a couple charges from a Minecraft or some game website from Europe (Sweden). I have 2 fraud charges. I think it has to do with the fact that you have your IHG card saved in your IHG profile!! I had just updated mine when this happened, I dont think its a coincidence!

I’ve had an issue with 3 different Chase cards, including my IHG card, in the last 45 days.

Glad to see this post, not because you are a victim, but because my wife’s IHG card had this issue as well. From reading the other comments, it definitely seems like the IHG card has an issue. I don’t recall IHG issuing a statement about being hacked

My Citi AmEx also had 3 fraudulent charges from Brazil and 1 from the US.

I hadn’t used this cards for several months and rarely before, basically just at Costco since they only accept AmEx.

I also had my Chase Ink credit card charged with two transactions for approx $38.00 at a gas station in Brazil about 6 months ago. Chase fraud protection notified me but you have to wonder how this happens.