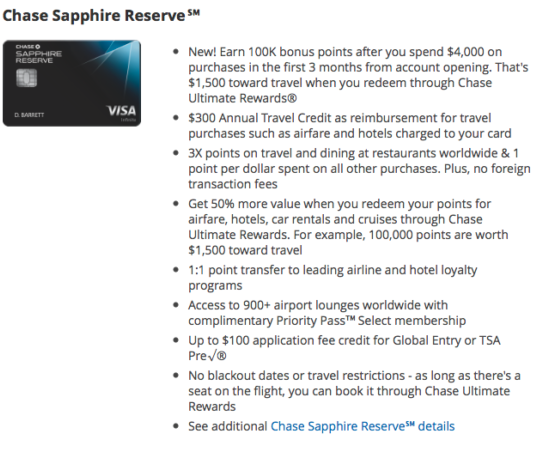

Last week, Chase rocked our world with the offering of an amazing 100K bonus points on the Chase Sapphire Reserve Card. The great news is that this offer is publicly offered (as of today 8/30/16.) You can see all the Banks that we have offer for here. To see all offers you can click on the “Other Points & Travel Credit Cards†tab under ‘Rewards Cards.’ Then check out the link that says “Click Here for card offers by issuing Bankâ€Â and scroll down to view all card offers from the bank that you are interested in.

Why I Applied For The Chase Sapphire Reserve 100K Offer

You may be considering this offer still and wondering if the $450 annual fee is worth it. The annual fee is not waived the first year. But, I think it’s worth paying the annual fee. Here’s why I applied for the card.

Benefits Of the Card That Offset The Annual Fee

- You will earn 100,000 Chase Ultimate Rewards points which is worth about $1,500 in travel booked through the Chase Portal after completing the minimum spending requirements.

- The Chase Sapphire Reserve gives you Priority Pass Select for access to airport lounges.

- You also get $100 statement credit for Global Entry or TSA PreCheck.

- You also get the $300 Annual Travel Credit as reimbursement for travel purchases such as airfare and hotels charged to your card.  So you’ll be able to earn the $300 in 2016 and get the $300 credit again in early 2017.  Basically, you will be earning $600 in travel credit with just 1 $450 annual fee.

Bottom Line

I’m pretty excited about the Chase Sapphire Reserve Card offer and I think it’s worth paying the annual fee. The 100K bonus points is with about $1,500 toward travel when you redeem through Chase Ultimate Rewards®. You also get the $300 Annual Travel Credit as reimbursement for travel purchases such as airfare and hotels charged to your card.  So you’ll be able to earn the $300 in 2016 and get the $300 credit again in early 2017.  Basically, you will be earning $600 in travel credit with just 1 $450 annual fee. Pretty sweet! How about you, have you applied for this offer yet?

Leave a Reply