When it comes to getting approved for new Chase Credit Cards, I seem to be all over the place. Sometimes I can instantly approved for a $28,000 credit limit, sometimes a $500 limit, and other times denied (primarily to the 5/24 rule). However when comes to everyday spend, only having a $500 on a new Chase card isn’t going to be useful especially if trying to meet minimum spend.

Last week I applied for two Chase credit cards, the Hyatt Credit Card as well as the Chase Freedom Unlimited. I was instantly approved for the Hyatt Credit Card with an extremely high credit limit, however the Chase Freedom Unlimited, while approved was only for a meager $500.

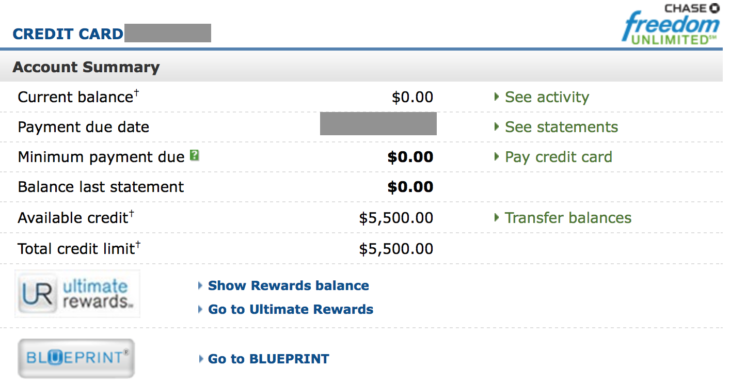

$5,500 is a lot better than a $500 credit limit

I waited until I received both cards in the mail and activated them before calling Chase up. You can use the number on the back of any of your Chase cards and the customer service agent should be able to help. I said I wanted to move credit from my Hyatt card to the Freedom card in order to increase the credit on this card. He asked how much I wanted to transfer, and a few clicks late the credit limit transfer was complete.

Why Might You Want to Transfer Credit:

If you just got a new card and are trying to meet minimum spend, you may need to spend a lot more than your credit limit, which could make it challenging, however you could always prepay in advance which I didn’t want to do.

If you plan on canceling a Chase card, rather than losing that credit, you can transfer it over to another Chase card you have, and then cancel the other card while retaining the credit with Chase.

Note, it’s never a guarantee if they’ll let you transfer credit amongst card, but based on past experiences it seems like they are usually willing to. Also if you’re just applied for a credit card with Chase and are denied, you can call them up and see if they can transfer credit from one of your other cards to it, and they may reconsider and offer an approval.

What success do you have transferring credit with Chase? Feel free to comment below!

Can you transfer credit from personal to business? This new enhancement from Amex has me looking at alternatives.

I am currently at 23 credit cards opened in the past 24 months. Could you tell me how many you opened in the past 24 months since the Hyatt card supposedly doesn’t fall under the 5/24 rule with Chase?

I would love to know that, too! If this doesn’t fall under the 5/24 rule, I would definitely go for it. (but IHG wasn’t supposed to be either – got denied – womp womp)

What’s up friends, its fantastic article about tutoringand entirely explained, keep it up all the

time.