American Express Membership Rewards are earned from a variety of American Express cards, and are a great currency to have since they can be transferred to many hotel and airline partners including Air Canada, Delta, British Airways, JetBlue, Virgin Atlantic, and Hilton to name a few.

When transferring Membership Rewards points to U.S. airline frequent flyer programs however, you’re subjected to an “Excise Tax Offset Fee”, which is $0.0006 per point (with maximum fee of $99) per transfer.

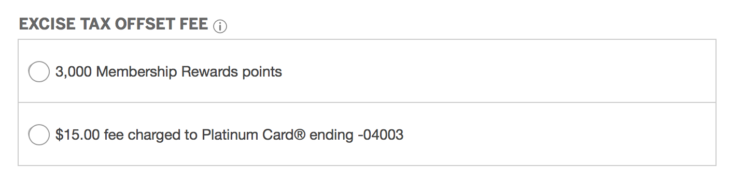

Here’s How Amex Describes the Excise Tax Offset Fee:Â Every time you transfer points into a U.S. airline frequent flyer program, your Linked Card account will be charged an excise tax offset fee of $0.0006 per point (with maximum fee of $99). We charge this fee to offset the federal excise tax we must pay when you transfer points. We may offer you the option to use points to pay this fee. You will be able to review these details before completing the transfer.

As an example, if you wanted to 25,000 Membership Rewards points from American Express to Delta Air Lines, you’d have to pay $15 as part of the excise tax offset fee. They do let you redeem Membership Rewards for this, however it’s not a good value to utilize this feature.

In order to avoid this fee with American Express, you’d need to transfer to a foreign carrier which include: Aeromexico, Air Canada, Air France KLM, Alitalia, All Nippon Airways, Asia Miles, British Airways, El Al, Emirates, Etihad, Iberia, Singapore Airlines, or Virgin Atlantic.

If you’re wondering if other credit card companies, where you can transfer points to airlines charge this fee, the answer is no. For instance when transferring Chase Ultimate Rewards to United MileagePlus, there’s no fees associated with this transfer.

Examples of Amex Cards that earn Membership Rewards points:

What are your thoughts on Amex’s Excise Tax Offset Fee? Feel free to add your comments below.

I think it’s asinine that they charge this. To offset their cost.

I’ve shared with American Express that it’s a shame it’s Membership Rewards customers have to pay this fee but it’s not charged on Delta branded American Express cards eating Skymiles.