Over the past several years, Delta has made numerous changes to its SkyMiles program. In 2014, Delta completely changed how passengers would earn SkyMiles flying by going from a distance flown calculation to one based on the base fare of the ticket price.

It would appear that ultimately Delta is trying to put a valuation of 1 cent per SkyMile based on these actions. For example, by removing the award chart, Delta can now tie an award redemption amount to the cash ticket price.

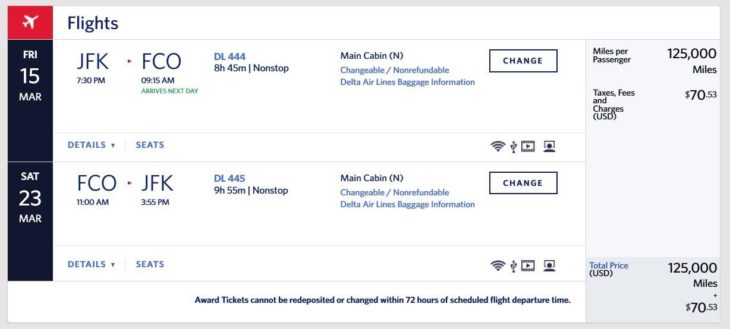

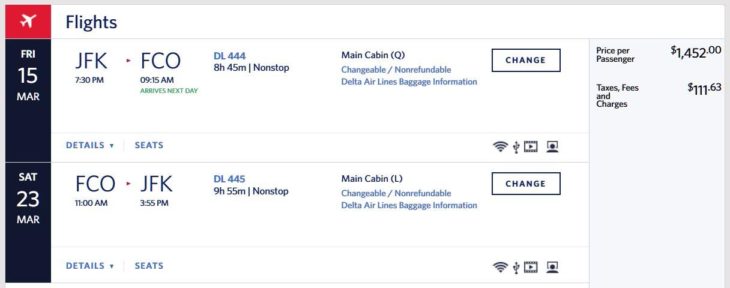

Below is an example of a trip from New York (JFK) to Rome (FCO) with an award price of 125,000 SkyMiles (+$70 in taxes/fees) or a cash price of $1,563 – a ratio of .0119 cents per SkyMile, but no Medallion Qualifying Miles earned.

When Delta overhauled earning SkyMiles in 2014, accruing miles became substantially more difficult as the system now became a percentage back of your ticket price for future travel. To elaborate, a Diamond Medallion earns 11 SkyMiles for every $1 in base fare.

On a $300 ticket with $35 in taxes will yield 3,300 SkyMiles or approximately 9.4% back of total purchase price that can be used towards a future Delta ticket (assuming a 1 cent to 1 SkyMile ratio and redeeming with Pay-With Miles). The rate decreases as other status levels earn between 7-9 SkyMiles and non-status earns just 5 SkyMiles per $1 in base fare.

Delta SkyMiles has added partners including American Express, Hertz, AirBnb, and has programs like SkyMiles Dining and a shopping portal to earn miles, however these offers match standard cashback credit cards and cashback shopping portals without restrictions that Delta imposes on redemptions.

From ordering a premium cocktail in a Delta SkyClub to redeeming for a Delta Vacation Package, the program has seen and will continue to see adjustments that make Delta SkyMiles a restricted currency that can be used within their large ecosystem.

Feel free to weigh in with your thoughts on Delta’s progression towards making SkyMiles a currency in the comments below.

Let’s compare with AA which has one-way award tickets on Sunday after thanksgiving for 75,000 in coach, or $1800 surcharges on BA redemption.

5 miles per $ X 1.2c = 6% back (Base)

11 miles per $ X 1.2c = 12% back (DM)

Seems on par with the hotel loyalty programs, but no one is complaining loudly about those.

Hilton

10 points per $ X 0.004 = 4% back (base)

20 points per $ X 0.004 = 8% back (Diamond)

Marriott

10 points per $ X 0.007 = 7% (base)

17.5 points per $ X 0.007 = 12.3% (Platinum)

IHG

5 to 10 points per $ X 0.005 = 2.5% to 5% (base)

10 to 20 points per % X 0.005 = 5% to 10% (Spire)

Hyatt

5 pts per $ X 1.5 = 7.5% (base)

6.5 pts per $ X 1.5 = 9.75% (Globalist)

Comparing to hotels? Apples to oranges. Hotels have availability every night.

If an airline would agree to have award tix available on every flight, then we would not mind a valuation closer to hotel programs. SWA has award seats all the time, so SWA flyers tolerate lower valuations.

All sorts of organizations have a currency type program it just depends on how you define it. I just don’t think it’s a good idea to devalue the earnings and devalue the awards to less than you could potentially earn using a cash back instrument instead. I also don’t think it’s a good idea to remove the “carrot” aspect to award programs by not having an award chart. I think we are starting to see some potential evidence of this with the Delta award sales.

Also some currencies are good. The US Dollar, Chase Ultimate Reward points, Marriott points

and some currencies aren’t as good. The Sovereign Bolivar, Delta Sky-rubles, Hilton points.