Current Chase offers two versions of their Sapphire credit card, the Chase Sapphire Preferred (which has a $95 annual fee after first year) and the newer Chase Sapphire Reserve ($450 annual fee) which was released in late 2016. Both cards have the signature metal insert, sophisticated front minimal design, and the card number on the same side as the magnetic strip side.

Best Strategy with Chase Sapphire Credit Cards

The main differences between these cards are that the Chase Sapphire Reserve offers some additional benefits and perks over the Preferred. For instance, this card includes a $300 travel credit (based on the card year), a Priority Pass Select membership (includes bringing up to 2 guest per visit), and statement credit for TSA Precheck/Global Entry (Trusted Traveler Programs).

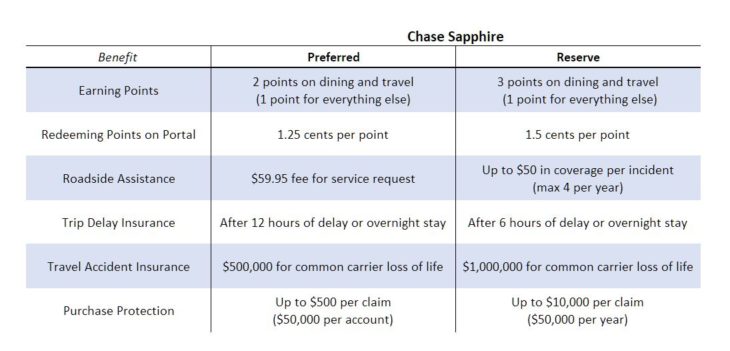

Both cards have several benefits that overlap with varying limits and coverage as outlined in the table above.

Both cards include baggage delay insurance up to $100 per day for up to 5 days, primary rental car insurance, and trip cancellation insurance up to $10,000.

Using Ultimate Rewards Points

Chase Ultimate Rewards points can be a fantastic value when transferred to affiliated hotels and redeemed for free nights. Currently Chase has three hotel transfer partners being IHG Rewards Club, Marriott Rewards, and World of Hyatt. See all the details of Transferring Chase Ultimate Rewards to Hotel Partners.

Additionally, Ultimate Rewards points points can be a fantastic value when transferred to affiliated airlines and redeemed for award flights. Currently Chase has 9 airline transfer partners with at least one airline belonging to either Star Alliance, SkyTeam, or Oneworld. See the full details of Transferring Chase Ultimate Rewards to Airline Partners.

Annual Fee

As stated earlier, the two cards have very different annual fees ($95 Preferred vs $450 Reserve), however the first-year fee is waived on the Preferred and still has the same sign up bonus. Unless you plan to spend a substantial amount on dining and travel in the first year or anticipate redeeming all your accrued Chase Ultimate Rewards points via their travel portal, the best strategy is to apply for the Sapphire Preferred first. Then, after the first year when the annual fee hits, product change to the Sapphire Reserve where the substantially increase in benefits makes the $450 annual fee a better value if you intend to use the $300 travel credit.

One major note, all Chase Sapphire cards fall under the 5/24 rule and new applicants are not eligible for a bonus if they had received one in the last 48 months.

You can view the current sign-up offers of the Chase Sapphire Preferred and the Chase Sapphire Reserve.

Feel free to comment below on the best strategy with Chase Sapphire credit cards and if you had any feedback to share.Â

Leave a Reply