The Platinum Card® from American Express includes numerous benefits that far outweigh it’s cost. Depending on your lifestyle and travel plans, these perks and benefits can provide a significant value.

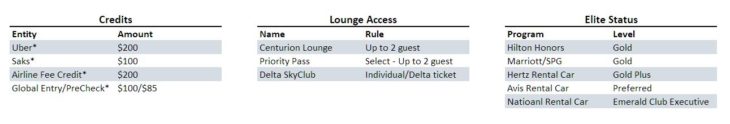

A quick sum of the yearly credits shows that you can get back $500 if you use Uber monthly, make a couple of purchases at Saks Fifth Ave, and are charged incidental fees by an airline. Additionally, every 4 years, the card includes reimbursement on the $100 Global Entry or $85 PreCheck cost from the United States Trusted Traveler Program.

- Card Link: The Platinum Card® from American Express

- Card Link: The Business Platinum Card® from American Express

As a cardholder, members have access to the expanding network on Centurion lounges. Currently located in 6 cities across the US with further planned expansion, the lounge is a great place to relax before a flight. The American Express Platinum also includes a Priority Pass Select membership which includes complimentary access for 2 guests. In addition, lounge access is included to Delta Sky Clubs when traveling on Delta.

With so loyalty programs, achieving elite status with several is increasing difficult. Fortunately, the American Express Platinum card includes elite status with Hilton and Marriott hotels as well as the major rental car agencies; Hertz, National, and Avis.

The American Express Platinum card sign-up offers vary substantially, and targeted offers can be as high as 100,000 Membership Rewards points after meeting a spend threshold. All purchases earn 1 point per $1 except for airline and hotel purchases which earn 5 points per $1 when booked through American Express travel (airline tickets can also be booked with the airline directly for 5x). As one of the best reward programs, Membership Reward points are versatile. Options include several airline and hotel transfers partners, cash or gift card redemptions, as well as the ability to redeem directly for travel.

Weighing in at 19 grams, the metal American Express Platinum is a noticeable card. Members have AMEX concierge services, fees waived for booking using AMEX travel, and access to the Fine Hotels and Resorts collection. The card is definitely best for those who frequently travel, but every individual should evaluate the value of each benefit.

- Card Link: The Platinum Card® from American Express

- Card Link: The Business Platinum Card® from American Express

“Members have […] fees waived for booking using AMEX travel […]”

Is that accurate? I understood that Centurion (black card) AMEX members have fees waived, but I’ve still been charged the $29 fee for phone support for tickets through AMEX, even for things (like the unpublished discount business-class fares) that cannot be booked without phone support.