We recently shared of Lucrative Amex Platinum Retention Offer, which 50,000 Membership Rewards points or a $500 statement credit if I agreed to keep the card. This was offered over the phone by calling American Express’s retention department at 800-452-3945 where I was prompted to enter my 15 digit card number.

However, I had another card with an annual fee come due which was the Delta Reserve American Express. I wasn’t planning to keep this card with the $550 annual fee, so I decided to message American Express via its chat feature from my online account.

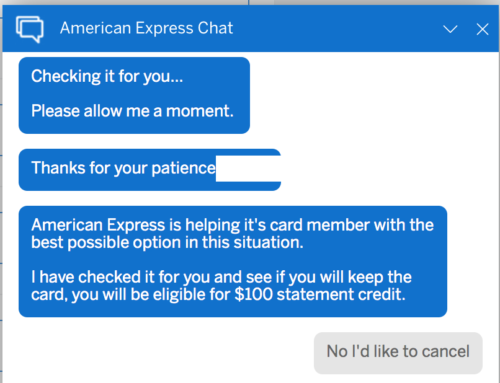

I told the agent that I didn’t want to keep this card and wished to cancel. A few minutes later I was presented with a retention offer of a $100 statement credit to keep the card via chat. In the past, American Express will only make retention offers over the phone, however it does appear that they’re offering these same offers through its chat feature online if you’re thinking of canceling and just had your fee post.

Ultimately, I still ended up canceling my Delta Reserve card, as I had earlier accepted a retention offer of 50,000 Membership Rewards points to keep my Platinum Card, so for this year, I’ll be able to access the SkyClubs with the Platinum Card, assuming travel starts to pick up.

If you’re interested in seeing if you’re eligible for a retention offer, login to your American Express account and choose the chat feature in the bottom right hand corner. The agent will ask which card you’re inquiring about and then simply say you wish to cancel the card, and that should prompt them to offer a retention offer.

Pro tip: Always say you want to cancel the card, rather than just asking for a retention offer. The agent will not actually cancel the card as there is a long disclosure they have to give to you, so you can always choose not to cancel after the disclosure, but this ensures you’ve exhausted all possible retention offers on your account that you could be offered.

Have you received a retention offer from American Express through its online chat feature before? Feel free to share your success in the comments below.Â

Ha, not all banks do the disclosure stuff. I mentioned cancel to a Chase rep, she asked for a minute to bring up my account and then 60 seconds later said, ‘done, account is closed’.

Luckily Chase will re-open if you call back, but its a watchout

This is a little off topic, but still it’s about getting credits from Amex. I started the Amex Aspire card in late November and paid a partial AF of about $100 or so. This was an upgrade from the no AF Hilton card. The first full $450 AF then hit in March. I had read a lot on closing cards within a year of opening was frowned upon, and went ahead and paid the AF.

Of course after my anniversary date the unused prior Resort Credit was lost, I called and explained I was keeping the card, but largely due to COVID-19 I had been unable to use the Resort Credit (and I’m over 65 and had extra concern). They told me they would issue a $250 statement credit, and sure enough TODAY I GOT IT!

The customer service rep told me people with membership anniversary from January to May were eligible. Note I do NOT think I would have gotten it without calling, IT MAY BE WORTH A CALL FOR YOU.

So I’ve paid about $550 or so in AF. For these I have two weekend (now anytime) nights (with exspirations extended due to COVID-19), $250 statement credit, $250 use of new Resort Credit for restaurants (which I’ll use), and the 150,000 welcome bonus. I’m going to conservatively (I think) say this is worth $1,500 plus other benefits (Diamond, etc.), and could be worth be worth much more depending the two “weekend” nights,

This didn’t work for me. I asked to cancel my Amex Green card via online chat. I expected a retention offer to follow as the article suggests, but the agent then went on to cancel my card. I didn’t mind too much since I wanted to cancel it anyways, but I would’ve considered keeping it if I had a nice retention offer.

Received a 7500 points for retention on Amex Green via chat.

Carl WV: what is “AF”?

Didn’t work for me either. I didn’t even bring up retention offers, but the rep said they didn’t have access to the retention offers on card accounts and gave me a phone number to call to see what they are.

I asked about waiting the annual fee via chat and was offered 30k miles!

Just spoke with retention department at Amex for my Hilton Surpass card and was offered 10,000 bonus points if I wanted to downgrade to the no annual fee card instead of cancel or get the $75 prorated amount for my annual fee back. Before calling I saw that there was a 100,000 plus $100 statement credit offer for new applications so I’m going to get that offer instead of the 10,000 points.