Mrs. Weekly Flyer and I have criteria we look for when considering the addition of new credit cards to our wallet. First, the benefits have to align with our travel goals, and second the bonuses and benefits have to be good.

But we always keep in mind common mistakes to avoid when applying for new credit cards, you can read our thoughts on that by clicking this link. So when I set out on adding a few needed credit cards to my wallet, I took those guidelines into consideration, and tried to one-up Mrs. Weekly Flyer on her latest credit cards.

She recently earned a total of 50,000 points from the Citi ThankYou® Premier Card, a new option to use Bluebird® by American Express to pay everyday bills, and an ability to earn up to 5% cash back and a $100 statement credit with the (expired) Citi® Dividend Platinum Select® Visa® Card card offer.

I had a little help this time though. In that a great 100,000 offer came along and I went for cards overall with higher bonuses. I’ve outlined my approach below to earning 140,000 miles and points by applying and getting approved for 3 separate credit cards.

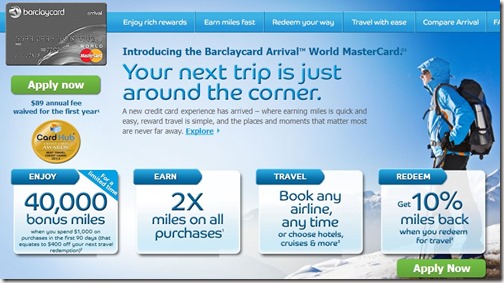

Card 1: Barclaycard Arrival Plus™ World Elite MasterCard®

The Barclaycard comes with 40,000 points after spending only $1,000 on the card in the first 3 months. The card also comes with ability to earn 2x points on all spending. But when you redeem your points for travel you’ll earn 2.2% back.

So the points from this card will be great for me to use for routine travel purchases. Fitting nicely within my guidelines.

Card 2: Citi Executive Card

I picked up this card because of the huge bonus and the ability to continue to access the American Airlines lounge after the latest policy change. I’ll earn 100,000 miles with this card plus great benefits.

Card 3: SimplyCash® Business Card from American Express

Link: Offer Expired.

My third and final card so far this year was to apply for the SimplyCash® Business Card from American Express. This offer is no longer available.

Pulling It All Together

By picking up a few credit cards I’ve been able to add 140,000 points and miles from signup bonuses to my balances, 40,000 bonus points from the Barclaycard Arrival Plus™ World Elite MasterCard® and 100,000 bonus miles from the Citi Executive Card.

How and where do you anticipate growing your point and mile balances this year?

Related Posts

- Avoiding Mistakes With Credit Card Sign Up Bonuses

- First Time Reloading Bluebird – Mrs. Weekly Flyer’s First Time Using Vanilla Reloadable Cards

- Mrs. Weekly Flyer’s Latest Application(s)–Cash Back, New Points, And A Must Have For Every Wallet

- Mrs Weekly Flyer’s Next Credit Card And Reasoning

- How To Get It In & Keep It In – In A Wallet That Is

- My Next Three Travel Award Credit Cards

- Update On My Next Credit Card Application Cycle

- What Happens When You Signup For Travel Credit Cards Too Fast

Sign up for Email || Twitter || Facebook || Tips & Tricks

Hotel Offers || Airline Offers || Bank Offers || Cash Back Offers

Points, Miles & Martinis will earn a referral credit for successful applications through the links in this post. We appreciate any support for Points, Miles & Martinis by using our affiliate links.

Disclaimer: This content is not provided or commissioned by the credit card issuer. Opinions expressed here are author’s alone, not those of the credit card issuer, and have not been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through the credit card issuer Affiliate Program.

Good job. I guess I should pick up that Citi Exec card before it goes away, huh? 🙂

I decided to pass on the Citi Executive card but did just get the Barclay Card as well as the regular 50K Citi Aadvantage card (for my wife)

I’m still trying to decide what cards to get for my latest – definitely the Southwest business card (to finish off my points needed for the companion pass) and I’m looking at the IHG card as well.

I wanted to get the CapitalOne Venture card but I’m waiting for the 50K offer to (hopefully) come back

These are cards that I have considered but I wouldn’t have considered the Simply Cash American express card. In this case, it might be a good idea because it offsets the annual fee on the Citi Executive Fee. I don’t know that I would use the Simply Cash card beyond the minimum spend. Also, do you think I would have an issue getting approved for another American Express if I already have 1 business and 3 personal American express cards. Thanks!

Hi Kathy – I can only speak from experience, but I have 2 business amex cards and 2 personal amex cards and was approved. I think it has to do with the credit extended, but am not sure.

Got 163,000 AA points from Citi Executive (100,000 points & 10,000 spend) and Citi Platinum (50,000 points & 3,000 spend) and $200 Executive statement credit. Got the 50,000 Cap 1 venture card all in January.