Last month I received the 100,000 bonus offer, which is a good offer, but not as good as 150,000 bonus points. In the first quarter of this year I received the same 150,000 bonus point offer and I took advantage of it. But I didn’t take advantage of the 100,000 offer a few weeks ago and today I’m thrilled about my decision because I just received another 150,000 bonus point offer.

Unfortunately, I’m in a dilemma with receiving the same offer again because it requires a significant amount of spending, $20,000 in order to maximize the sign up bonus. So do I go for another 150,000 bonus points from American Express with $20,000 in spending or do I use that spend for other credit card spending like the Delta Reserve or the Chase Ink card?

Who am I kidding, of course I’m going to go for the 150,000 bonus points. A 150,000 bonus point offer doesn’t come around very often, so when it does, it is important to take them up on the offer.

Of course you can always try to increase your chances of receiving these targeted offers (as I explain here), but when these offers come around, you really need to give them priority over other offers. For example, when the 100,000 American Airlines card offer came around, I jumped on it and received the 100,000 bonus miles. Then when it died and came back again I jumped on it again before it expired.

Offer Details

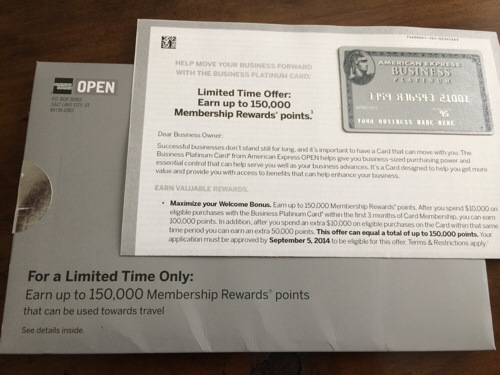

Limited Time (Targeted) Offer valid through September 5, 2014.

- Earn up to 150,000 Membership Rewards points

- Earn 100,000 points after spending $10,000 on eligible purchases in the first 3 months of card membership

- Earn additional 50,000 points after spending another $10,000 on eligible purchases in the same period

In order to use this promotion, each targeted offer recipient is given a unique invitation code that can only be used one time.

Bottom Line

While the 150,000 Membership Reward bonus is a huge number, the extra 50,000 requires an additional $10,000 in spending. Spending $10,000 in the first 3 months is a feat in and of itself, let alone another $10,000 in spending. One approach is to go for the first 100,000 points and then play the additional 50,000 point requirement by ear. But I’ll probably go for both of them for a total of 150,000 bonus points.

Regardless, I’m thrilled to have received this offer in the mail yesterday. Have you received a targeted offer lately?

If you haven’t, be sure to check out my post on how to increase your chances of receiving a targeted offer from American Express by clicking this link here.

Related Posts

- How To Increase Chances For Targeted American Express Offers

- Free Hilton Gold Status for Cardholders

- How To Transfer American Express Membership Rewards To Travel Programs

- How To Link Travel Programs To American Express Membership Rewards Program

- New American Express Platinum Card Benefits Announced

- New Business Platinum Card from American Express OPEN Offer Announced

Got it yesterday!

Hi Jake – Awesome! Let us know if you take advantage of it and get approved.

jealous – i can’t even get a 100k offer!!!

Am I able to use someone else’s invitation code? My friend received the 100k but does not plan to use it.

Any particular criteria to receive these targeted offers ?

Can you get the bonus points if you had the card previously?

I finally got the 150,000 offer today.. I think it might be because I’ve recently incorporated. I did get approved..the card should be at my door in 2 to 3 days..excited!

I wish! I followed what you said awhile back but no offers. I can meet the minimum spend too! Darn.

What about Amex”s one time per life policy on bonus offers. I have the platinum personal card. And the gold business. I received the platinum offer addressed to an internal email subject matter, not my business name. Am I able to get the offer given I have the two cards already?

Matt my wife used someone else’s code and got the points. If you are targeted again are you not limited to the once in a lifetime offer from Amex now?

Now I feel real stupid for taking the plunge for the 100k offer a month ago.